Datura Residences

Invest in the heart of West Palm Beach with Datura Residences: luxury, growth, and solid returns in a high-demand market.

Return Metrics for a 4-5 Year Period

$2,000,000 USD

20.3%

2.02x

Urban elegance in West Palm Beach

Premcore Capital offers you the opportunity to participate in Datura Residences, an iconic, Class A multifamily development with 182 luxury units in a 20-story tower, located in the vibrant heart of West Palm Beach. This landmark project benefits from its proximity to CityPlace, the popular Clematis Street corridor, and the Brightline train station, which quickly connects West Palm Beach to Miami and Orlando.

Datura Residences is designed to meet the growing demand for luxury housing in a dynamic environment with high purchasing power and sustained job and population growth.

The investment is structured as a rental-only multifamily development with a hotel component, with a build-out and stabilization strategy for later sale to an institutional buyer. The estimated investment period is 4 to 5 years, with a conservative analysis based on 5 years, prioritizing an early exit to maximize IRR and returns for investors.

West Palm Beach has established itself as "Wall Street South," attracting leading firms such as Goldman Sachs, J.P. Morgan, and BlackRock. Currently, over 4 million square feet of existing and under development Class A office space generates a growing demand for high-income employee housing. Datura Residences seeks to capitalize on this opportunity by offering a luxury product in a market with a shortage of residential supply.

A net return for investors of 20.3% (IRR) is projected with a multiple on investment (MOIC) of 2.02x, reflecting the attractiveness and strength of the real estate market in West Palm Beach.

Datura Residences is a collaboration between Corner Companies and LD&D, a team with proven experience in high-impact real estate developments and strategic vision. This project is designed to offer exclusivity, sophistication, and solid returns in a high-demand market.

The Project

Exclusivity and sophistication in every detail

Datura Residences is an iconic, Class A multifamily development designed to meet the growing demand for luxury housing in downtown West Palm Beach, in a prime location that attracts both high-end residents and visitors. This project combines luxury residences, hotel services, and dining experiences in one location, creating a unique appeal for the modern lifestyle.

Project Features:

- 20-Story Residential Tower housing 180 luxury units for multi-family rentals, along with a 130-room hotel that provides a comprehensive experience of hospitality and style.

- Amenities: The hotel will feature a restaurant/bar on the first floor, offering a high-quality dining experience. The multifamily tower's exclusive amenities on the 20th floor include a pool, fitness center, and lounge, designed for resident comfort and privacy.

- Architectural Design and Style: Created by the prestigious Corwil Architects studio, the building's design combines modernity and functionality to maximize space utilization and efficiency.

- Interior Design and Branding: EoA Group is responsible for the interior design and brand identity, achieving a sophisticated and modern environment that aligns with the residents' exclusive lifestyle.

Development plan

Location

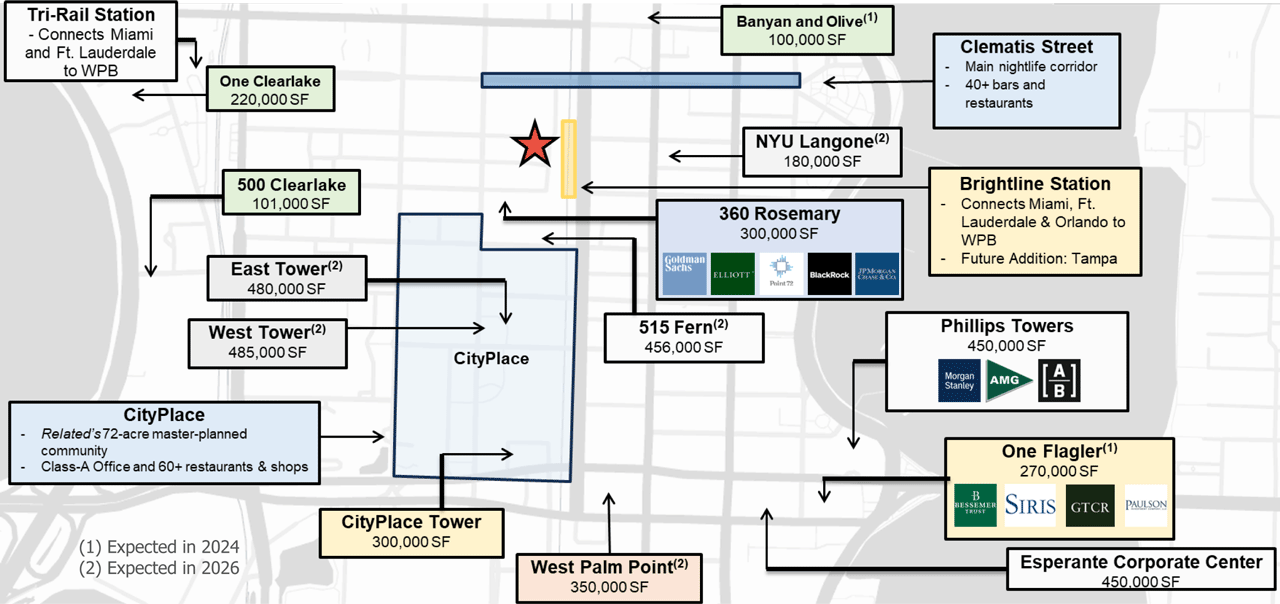

surrounded by approximately 4 million SF of class A offices

Location: 506 & 524 Dature Street, in the heart of West Palm Beach, FL, one of the most vibrant and exclusive areas of southern Florida.

West Palm Beach: The new financial epicenter nicknamed "Wall Street South"

West Palm Beach has emerged as a key destination for financial and high-profile companies, attracting more than $1 trillion in assets under management and transforming into a strategic hub for Class A offices. With the increasing migration of elite talent and companies, this market is at the center of economic growth and demand for luxury developments.

Sources: Bloomberg, Real Deal, New York Post, Forbes

Dynamic Environment:

- Located between CityPlace (a master-planned community with shops and offices), Clematis Street (nightlife corridor), and the Brightline train station.

- Just steps from 4 million SF of Class A office space occupied by leading firms such as Goldman Sachs, J.P. Morgan, and Bloomberg. Morgan and Blackrock.

Location Benefits:

- Connectivity: The Brightline station connects to Miami and Orlando in less than two hours, offering convenience for residents and visitors.

- Sustained Growth: WPB is known as “Wall Street South” for its attractiveness to financial firms and high-level talent, creating a steady demand for luxury housing.

Expanding Market:

- West Palm Beach has seen unprecedented population and job growth, with an 8.3% increase in jobs since 2019.

- Rising rents, with an average annual growth of 7.1% over the past four years, reflecting the shortage of Class A housing.

Investment Opportunity in West Palm Beach

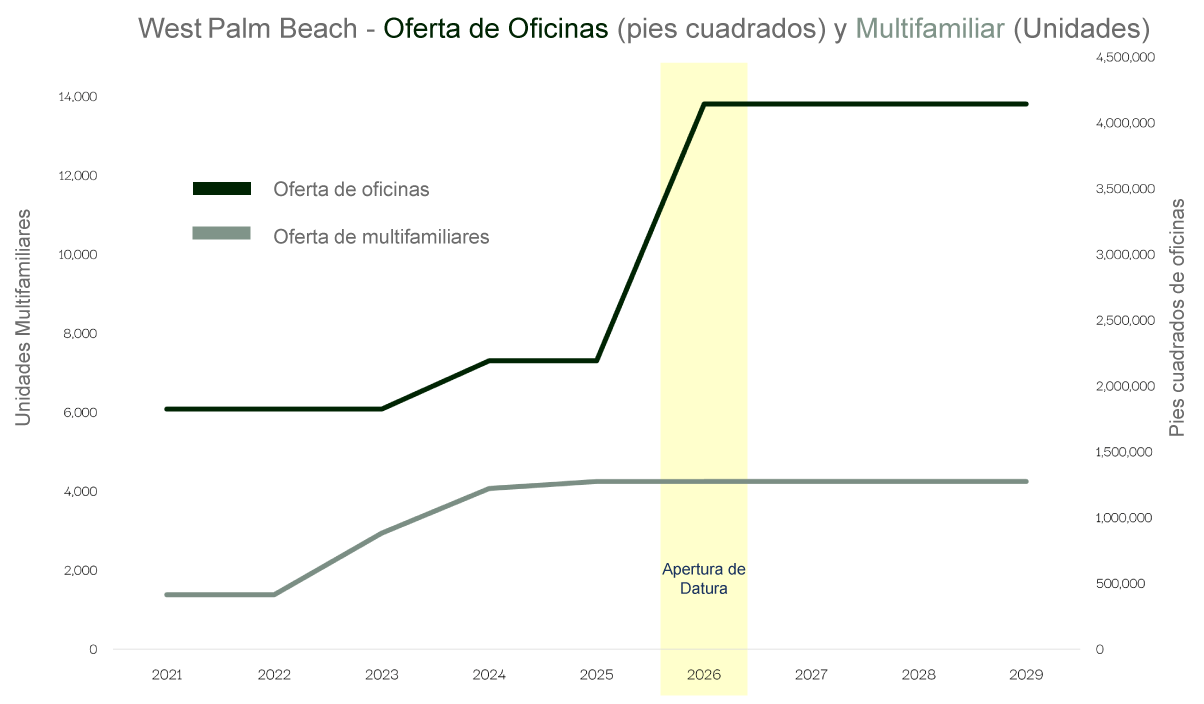

Residential Supply Lags Behind Office Growth

The rapid expansion of Class A office space in West Palm Beach has significantly outpaced the development of multifamily residential units. By 2026, the office supply in West Palm Beach is projected to double, surpassing 4 million square feet. In contrast, the supply of multifamily units remains virtually static, creating a significant imbalance in the market.

This office growth will increase housing demand by approximately 6,500 additional units, highlighting a strategic opportunity for residential developments that meet the needs of high-income employees in the area. Datura Residences is perfectly positioned to capitalize on this growing demand in a market with a housing shortage.

Project Indicators

The summary applies to the multifamily component; the hotel component is a separate investment vehicle.

General Information

- Zoning: Approved, QPB 10

- Development Use: Class A Multifamily Residential Tower

- Land Value: $8,125,000

- Land Value per Square Foot: $295

- Residential Unit Value: $44,643

- Lot Size: 0.63 acres | 27,552 SF

Development Program

- Floors: 20

- Estimated Gross Area (GSF): 295,273 SF

- Net Floor Area (NSF): 143,331 SF

- Efficiency: 53.5% (assuming 1x1 parking)

- Parking: 242

- Number of Units: 182

- Average Unit Size: 788 SF

- Total Development Cost: $94,340,821

- Cost per Unit: $518,356

Return Metrics for a Period of 4 to 5 Years

- IRR for the Investor: 20.3%

- Total Profit: $31,569,132

- Investment Multiple (MOIC): 2.02x

- CAPITAL REQUIRED: $2,000,000 USD

The team

Strategic experience and vision to build high -impact projects

Hernán Rincón Lema

Chairman de Corner Companies

He has more than 40 years of experience as a global corporate and executive leader. It was CEO and president of Microsoft Latin America, as well as Avianca, where he led the expansion of both companies in the region. Hernán is recognized for his deep knowledge in investments and his ability to manage high performance equipment. It has a Harvard University MBA and an MSC from the University of Los Andes.

Rafael Rincón Juri

Managing Partner of Corner Companies

He directs real estate investments in the United States, with an approach to the portfolio strategy, structuring of agreements and capital management. With a trajectory that includes key roles in Greystar Real Estate Partners and Canada Pension Investment Board, Rafael brings his experience in institutional investments. It is MBA by The Wharton School and MSC for the London School of Economics.

Karen García

Director of Business Strategy and Development at Corner Companies

She has more than a decade of experience leading the transformation of companies. As CEO in the waterproofing sector, she managed to position her company as a leader in Colombia, increasing her income five times. Her knowledge in strategy and relationships with investors is essential for the success of Corner Companies. Karen has a degree from the University of Los Andes.